Navigating Wealth: A CEO Discovers the Need for Financial Planning Services

By Acen Hansen

John blinked at the spreadsheet on his computer screen, bleary-eyed from staring at it for the past three hours. As the owner of a variety of successful businesses, he was used to looking at financial statements and projections. But this time, as hard as he squinted at the numbers, he just couldn’t make sense of it all.

"I must need another cup of coffee," John muttered, rising from his desk. His feet ached as he plodded to the kitchen. While waiting for the coffee maker to finish gurgling, John gazed out the window at the immaculate garden in his backyard. His gardener kept everything pruned to perfection.

If only managing money was that simple, John thought. But his ever-increasing wealth brought with it ever-increasing complexity. He owned multiple businesses, substantial investments, and real estate. Keeping all of it straight was becoming impossible.

The Complexity of Wealth Management

Just then, John's phone buzzed with a text from his friend David: "Hey! Are we still on for golf tomorrow?"

John had forgotten about his standing golf game. He quickly typed back: "Can't tomorrow. Need to sort out a financial mess. My spreadsheet looks like alphabet soup."

David replied: "Dude, you need to talk to my team over at Legacy Integrated. They are wizards with money and investments. I'll send you their info."

John frowned down at his phone, unconvinced. He'd always managed his own finances. But as his wealth grew, things kept getting more tangled. With a sigh, he sent back: "Okay, I'll give Legacy Integrated a call. I need a money miracle."

Financial Planning Tailored for John

After meeting with Legacy Integrated, John was amazed at the team's grasp of complex wealth management strategies. They showed John how proper entity structure could reduce his tax burden while still keeping things fairly simple and achieving his financial goals. They also showed some investment principles and opportunities John didn’t even know existed. They showed him how they could take on the analysis work that’s taken hours of his time every week and show him the important data points so he could quickly make the right decisions. This expertise freed up more of John's time allowing him to focus on leading his company and enjoying more time with his wife and children.

Unlocking New Investment Opportunities

Legacy Integrated maintains close relationships with industry peers, providing access to unique investment opportunities not available in the open market. Now, by partnering with Legacy Integrated, John can access these investment opportunities as well.

Estate Planning

John was equally impressed by Legacy Integrated's estate planning recommendations, which elegantly addressed John's legacy aspirations with a focus on tax-efficient wealth appreciation and wealth transfer. Properly structuring wills, trusts, asset titles, and beneficiary designations required a level of expertise that Legacy Integrated expertly provided.

Risk Management

Legacy Integrated also evaluated John's insurance needs, for both liability protection and wealth preservation. Legacy’s advisors created an entity structure that reduced his potential liability should he ever be on the wrong end of a malicious lawsuit and ensured he had sufficient insurance coverage by strategically structuring cost-effective life, home, auto, and business liability insurance policies custom-tailored for John's specific needs.

Finding Financial Peace of Mind

For the first time in months, John felt at ease with his financial situation. With Legacy Integrated's expertise guiding his financial decisions, John was confident that his substantial wealth and many businesses were in capable hands. The numbers finally made sense again.

John realized that managing money at a high level required specialized skills. While he was great at leading his employees, he recognized the necessity of seeking assistance on the business finance, personal cashflow and wealth management front. Legacy Integrated's full-fledged financial expertise gave John the confidence and peace of mind he had been missing.

You too can experience this peace of mind with Legacy Integrated's services. Our experts assist high-net-worth individuals and business owners optimize their financial stewardship allowing them to continue to grow their impact in their community and create a lasting Legacy.

*John is based on a composite of the experience of several clients with Legacy Integrated.

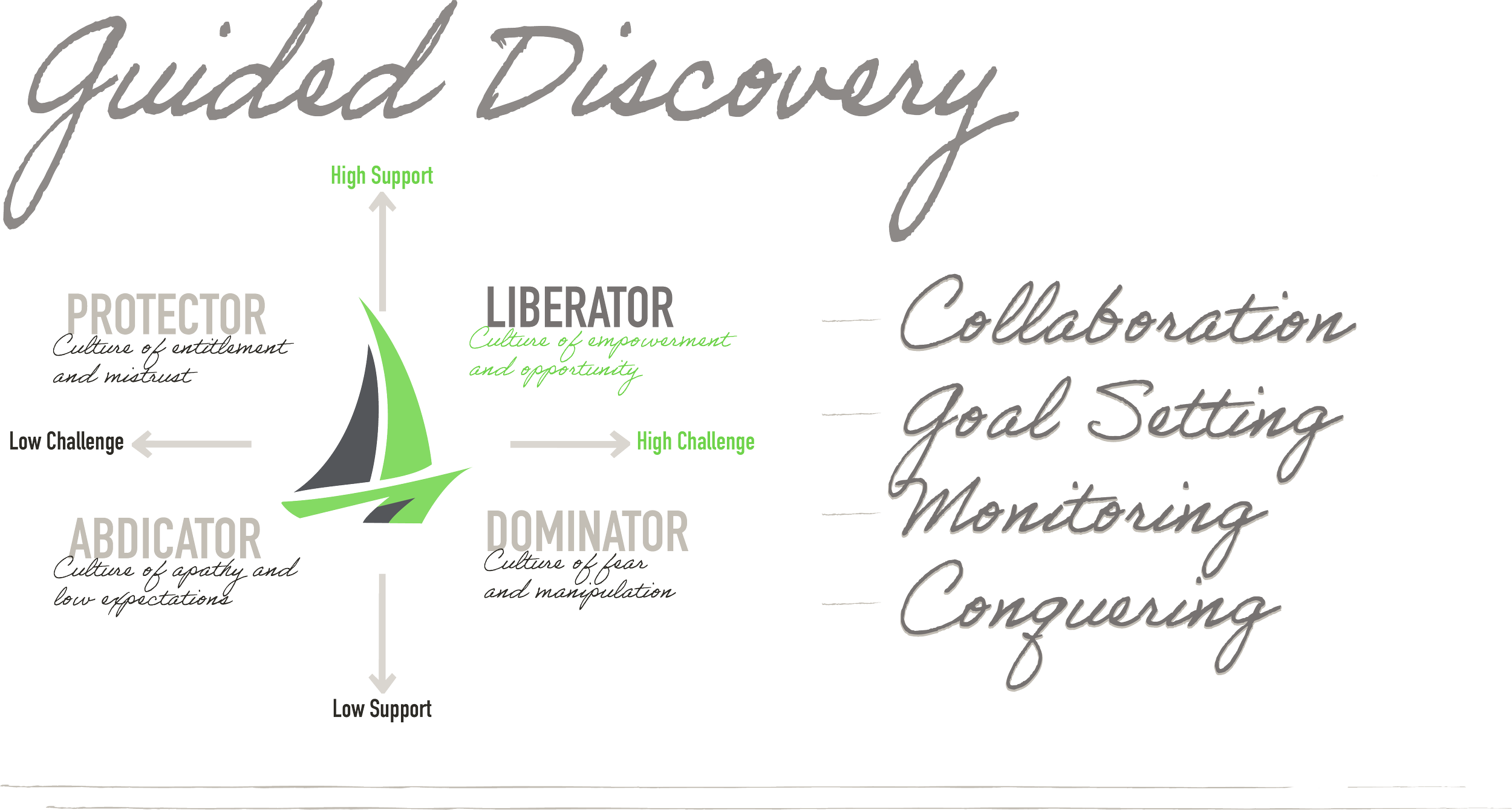

Introducing: Financial Guided Discovery

Our way of educating clients on our thoughts and strategy behind what we do and why we do it. It’s more than just saying “trust us”, Financial Guided Discovery means that your knowledge grows along with your portfolio.

LIFE INSURANCE THAT FITS YOUR LIFESTYLE

Find the right insurance to protect your assets, retirement, and health care options. When you protect what matters most, you give yourself and your family peace of mind.